Private Equity investment

The momentum around alternatives is accelerating

The foreseeable rise of alternatives

Global public equity and bond markets have been volatile since the start of the year. Inflation is proving to be stickier than first thought, and markets are therefore pricing in more rapid monetary policy normalisation. Economic data and earnings momentum have become more mixed too.

Amid all of the short term uncertainty, some investors are looking at the long term approach of private markets to help ‘look through’ some of this volatility. That long term approach can also be well suited to participate in the long term trends and themes that are part of ‘Resilience Redefined’, i.e. the digital transformation, the sustainability revolution and Asia’s new growth model. These three big trends will need a huge amount of funding, which will come from the bond and equity markets, but also from private markets.

Another reason for the interest in private markets is that, in spite of the recent correction, equities and bonds are still relatively highly valued, and monetary policy normalisation may challenge those valuations. In fact, we measure the long term, annual expected return on a traditional balanced portfolio at 4.6 per cent in US dollar terms. That’s well below the current inflation level, way below historic levels, as well as what most investors require and assume, particularly given the arrival of elevated inflation. Many investors, therefore, are making greater use of alternative asset classes as an additional source of return, and our long-term return forecast for private equity is 7.4 per cent (Source: HSBC Asset Management). Diversification properties may be even more compelling considering the challenge ahead for bonds as a reliable equity hedge, given rising policy rates and some of the highest inflation readings in decades.

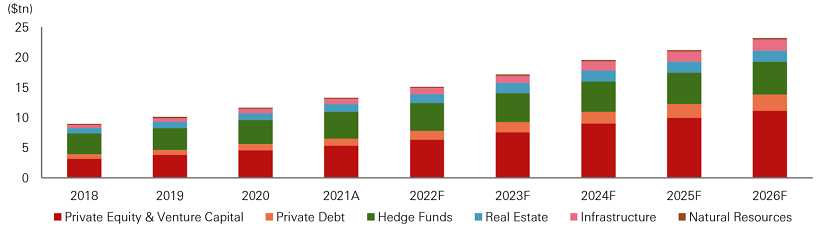

In a world where most asset classes are either neutrally-valued or looking rich, and where bonds don’t act as a reliable equity hedge, embedding alternatives into asset allocations is naturally becoming mainstream. In the past, alternatives were largely off-limits to most but the bigger institutional investors. This doesn’t come as a surprise since larger structures usually have more resources to assess the risk and opportunities associated to the inclusion of new asset classes in their allocations – and have the necessary scale to access more opportunities. But the hunt for yield and diversification, associated to wider product availability should continue to push more investors – of all scales - to integrate alternatives in their asset allocations. This is what we observe from our continuous dialogue with family offices. The investment industry appears to agree, with data provider Preqin, forecasting assets invested in alternatives to grow an impressive 15 per cent per year to reach USD17 trillion by 2025.

But of course, investors thinking about alternatives need to consider the higher fees and important suitability considerations, including the ability to tolerate illiquidity, outlined in more detail later in this piece. In addition, PE returns are very much dependent on manager selection and due diligence and investing in first or second quartile managers as there is considerable return dispersion between managers.

Private equity at the forefront

As illustrated below, private equity is the largest segment within the asset class. It already represents more than 40 per cent of total assets under management and is expected to represent more than half by 2025. This means that PE assets should double and reach around USD9 trillion.

Figure 1: Alternative Assets under Management and Forecast

Source: Preqin Forecasts, 2021 figure is annualized based on data to March.

Given the return and diversification benefits, investors are increasingly willing to sacrifice liquidity to benefit from new potential sources of returns. Indeed, it is rare that families need the entirety of their assets to be liquid. Some also see the opportunity to invest in new investment themes, accessing innovative companies at very early stages of their development.

Private equity is a vast, diverse and fast-growing investment universe. Consequently, not all private equity investment solutions are created equal. Venture capital, primary, secondary and co-investments all come with their own characteristics and specificities. Similarly, investing directly or via mutual funds would imply different outcomes.

The world of private equity

A commitment approach

Structurally, private equity is less liquid than its public counterpart due to the lack of active secondary markets for the assets as well as common restrictions on the transfer of individual investor interests in PE funds.

However, the lack of public shareholders means there is less regulatory burden involved in the PE market, so companies can focus on longer term strategies rather than being constrained by quarterly reporting. Yet this also means less transparency or access to information.

Therefore, when investing in private markets, PE fund managers can benefit from two additional premiums not present in listed markets - illiquidity and complexity. These two risks imply that investors are compensated for endorsing them. Like any other risk, these two can be managed with the appropriate skills and resources, making due diligence a crucial component of the selection process.

Private equity strategies

There are a variety of approaches that can be taken across different points of a company’s lifecycle, as shown in Figure 2. These strategies include:

- Venture capital: Refers to investments in private companies at the earlier stages of their development that have the potential for rapid growth. The funding given to early-stage start-ups is often used to build out the operation and structure of the company, with the investor receiving a stake in the business in return. These stakes are often minority investments, allowing private companies to still retain control but benefit from the expertise and guidance of venture capitalists

- Growth equity: When a company is more established as it progresses through its lifecycle, growth equity strategies come into play. Though the company is maturing and can offer goods or services at a profit, additional funding through selling a stake to a growth equity PE fund gives the company the capital required to scale up

- Buyout strategy: Usually involves taking a public company private through a purchase by either a private equity firm or its existing management team. This can be funded by the existing management team (management buyout) or with a combination of equity and a significant amount of borrowed money (leveraged buyout). In comparison to growth and venture strategies, buyouts involve a change of ownership, with the management team or private equity firm holding majority control of the company in question

- Turnaround or distressed strategy: Investing in distressed companies to take control with the aim of restoring the company’s profitability. This usually involves major changes to the company, both management-wise and structurally

Figure 2: Illustration of private equity strategies across a company’s lifecycle

Source: HSBC Asset Management (January 2021). For illustrative purposes only, not to scale

Ways to access private equity

Private equity can be accessed through three main markets: primary, secondary and co-investments.

- Primary markets form the foundation of private equity, involving direct investments at the time of inception of a closed-end private equity partnership. Primary investments are usually characterised by a longer investment period, and higher return potential. These closed-ended funds typically have a ten-year life within which capital received is drawn down, usually over five years, when suitable companies that fit the strategy of the fund are identified. However, due to the nature of capital being committed in advance, PE fund managers take on blind pool risk as they are unaware of the investments that will be made, and we note that performance fees detract from performance

- Therefore, the secondary market can offer increased liquidity and greater visibility through acquisitions into either large portfolios of existing funds or single funds with a small number of companies remaining. Acquisitions usually take place after three years into a fund’s life, i.e. the majority of capital has already been deployed and the fund is closer to an exit. Secondaries therefore tend to offer faster deployment, accelerated return on capital, and lower risk due to early write-offs and losses. Underlying assets can be individually assessed and PE fund managers who need liquidity are able to sell their stakes in the secondary market although available valuations may be more or less favourable

- Co-investments involve investors buying into a company directly alongside the PE fund manager (known as the general partner), providing a more hands-on approach for investors, allowing them to tailor their portfolio composition further. These investments are typically free of performance and management fees, giving investors the potential to get an uplift in performance

The return cycle: Straightening the J-curve

What is the J-curve

A well-documented phenomenon for investing in private equity is the J-curve. Simply put, it conveys the idea that the return and cash flow profile would be negative for the first few years of a PE investment before generally turning positive in the latter years, for reasons explained in the sections below. The takeaway is that PE investors need to be patient to wait out a period of lagging performance before they can reap the potential rewards.

Primary investments

So what causes the negative returns in the early years? First, the fund manager generally does not deploy the capital immediately when investors make an investment into a primary PE fund. Candidate companies need to be identified; due diligence research needs to be undertaken; the terms of acquisition need to be worked out – these steps take time, and all the while fees and expenses are incurring. Secondly, when capital is finally called and channelled into a target investee company, one also should not expect returns right away. For example, if the target company is one originally in distress, it would take time to reform and revive the business before it might deliver attractive returns. On the other hand, if the target company is a growth company in an early stage of development, it might need to continually require heavy capital expenditures in order to grow and gain market share, before the business could mature and turn decent profits.

A stylised J-curve of a primary PE investment is shown in Figure 3 below. Assuming a 10-year horizon, the return would remain negative until the 3-year mark, for the reasons we have mentioned above. When the fund’s acquired companies begin to deliver, the return curve finally bends upward to give its iconic J-shape.

Figure 3: Stylised J-curves for primary and secondary private equity investments

Source: HSBC Asset Management (January 2021). For illustrative purposes only, not to scale

Secondary investments and co-investments

The secondary market of private equity investments exists because some primary fund investors might want to exit a fund before it runs its full course, so would sell their stakes in the secondary market. Investors buying into these so-called ‘secondaries’ could potentially avoid the negative portion of the J-curve and also commit to a shorter investment horizon. But they do so at the cost of generally lower lifetime returns for their investments. This explains the difference in the Figure 3 illustration of a return curve for a secondary investment.

A similar dynamic is in play for a co-investment, which in essence is just a secondary investment in an individual company rather than a fund. All of this brings out the main point that, as with public equities, there is a risk-reward trade-off with private equities. Some investors might be willing to stomach a deeper trough at the onset of the J-curve for better potential future returns, while others might be willing to accept lower returns in order to avoid the initial dip. For investors with a particular risk-return profile, a sensible strategy to consider would be to invest in a fund of funds that has just the right mix of primary and secondary investments to produce the profile that they desire.

Responsible investing in private markets: not an oxymoron anymore

Research by HSBC and Boston Consulting Group has highlighted small and medium sized enterprises as a ‘new front’ in the battle against climate change, with a quarter of small businesses believing that a focus on environmental sustainability will grow their business in the next 12 months. The takeaways emphasise the need for creative solutions to support the transition of SMEs to net-zero emissions, given they lack the access to capital or in-house expertise of larger businesses. Furthermore, much of the innovation to drive the net-zero transition is set to come from what are early stage companies today, with specialised technologies and solutions.

Consequently, private equity and venture capital managers can play a key role in helping businesses both participate in and drive the transition. In addition to the importance of capital to support innovation towards mitigating and adapting to climate change, there is opportunity to work closely with management to increase awareness and action on broader sustainability and ESG issues. Since private equity involves true allocations of capital, rather than just trading, as per secondary markets, PE fund managers can have much more influence over businesses when they are deciding whether to give them money, or threatening to withdraw it.

Investor suitability: Private equity is not a ‘G-rated’ asset class

Sophistication required

Movies rated G are suitable for all ages. By analogy, private equity investments are surely not a ‘G-rated’ asset class and generally require a certain level of investor sophistication. Among many reasons why PE is only suitable for highly sophisticated investors who meet the eligibility requirements, three particularly stand out – the unavailability of convenient pricing information; the lack of liquidity; the risk of not fulfilling a capital call. Further explanation of these three characteristics of PE investments are given below. Funds and fund of funds structures could provide mitigation for some of these risks particular to PE, but surely not eliminate them entirely. Therefore, it would serve family offices well to understand PE-specific risks thoroughly before deciding to commit to this asset class.

Limited pricing information

Ticker prices of actively traded public equities are available down to the millisecond. This is far from the case of private equities. A PE fund manager would estimate the valuation of its fund on a quarterly basis and update its investors accordingly. But real pricing information would not be available until the fund starts selling its acquired companies back to the market, and even then the market value of the entire fund would still not be completely known until the fund has run its full course. In short, throughout the whole life cycle of a PE fund, there is a varying degree of uncertainty to its market value. That said, the lack of always readily available price information might not necessarily be a ‘bad’ thing for investors, even if the NAV used by fund managers can differ from the true market values. Nevertheless, for those who have been familiar with continuous price quotes in the public market, this perhaps is a serious point of consideration.

Lack of liquidity

Once again drawing a contrast with public equities, when a need arises for an investor to sell its stake in a PE investment, it is much more challenging to find a buyer than is the case with an exchange-traded stock. While a secondary market does exist, the transaction process is much more involved than selling a public stock. Due to the lack of pricing information, liquidity and common restrictions on the sale or transfer of individual investor interests in PE funds, negotiations with a buying party might take weeks, also potentially resulting in a large liquidity discount to the selling price. Therefore, an investor in a primary PE investment might want to have the expectation at the onset to hold on to their stakes for the entire life of the fund, typically lasting around ten years. Prospective PE investors might want to check that this time horizon is in line with their investment objectives.

Funding risk

Generally speaking, when an investor decides to commit a certain amount to a PE fund, say 10 million dollars, it needs to put up a portion of the committed capital right away as ‘initial drawdown’. Eventually, the investor will need to inject the rest of the full committed amount into the fund, through a series of capital calls by the fund manager when attractive opportunities are identified. For our hypothetical scenario, let us assume the initial drawdown is 3 million dollars. Two years later, the fund manager finds an attractive target company it wants to acquire for the fund, and makes a capital call for 2 million dollars to the investor. If for whatever reason the investor could not fulfill this capital call, it would be seen as a ‘default’ on the investor’s initial commitment. To safeguard their own interests, fund managers usually impose strict penalties for such occurrences, ranging from relatively mild (i.e. a forced sale of the investor’s interest back to the fund manager) to severe (i.e. an investor might need to forfeit all previous capital contributed and profits generated). In our example, the investor could lose the 3 million dollars it has already put into the fund. This in essence is the ‘funding risk’ of a PE investment.

Mitigating the risks: A fund of funds structure

A fund of funds approach to investing in private equity can mitigate some of the aforementioned risks. For example, as a fund of funds usually contains a significant portion invested in secondaries and co-investments, there would be less uncertainty around its market value compared with a primary PE fund. It is also generally easier and less costly to liquidate one’s stake in a fund of funds as opposed to selling one’s interest in a PE fund. Furthermore, a fund of funds structure also brings about diversification benefits as it allows investing in a broader breadth of private companies in a wider range of industries with varying characteristics. Finally, one needs to commit substantially less capital in a fund of funds. All these and other benefits would come at the cost of higher fees, of course.

Concluding comments

With our long-term expected return forecast of 7.4 per cent, the appeal of private equity as portfolio ‘return enhancers’ has contributed to the appetite of family offices. In a context of rich equity valuations and policy rates biased to the upside, the illiquidity and complexity premia that the private equity market can provide make it an appealing prospect, at least for investors who understand the pros and cons, and can benefit from the skills and resources of a manager able to provide them with solutions that meet their specific objectives and constraints. Where suitable, we therefore generally include private assets in well-diversified portfolios: we see them as another way to capture the beta of equity or credit markets, with the potential for some alpha, while also broadening the opportunity set to issuers that may not be present in public markets.