Find out how we can help with your investment strategy

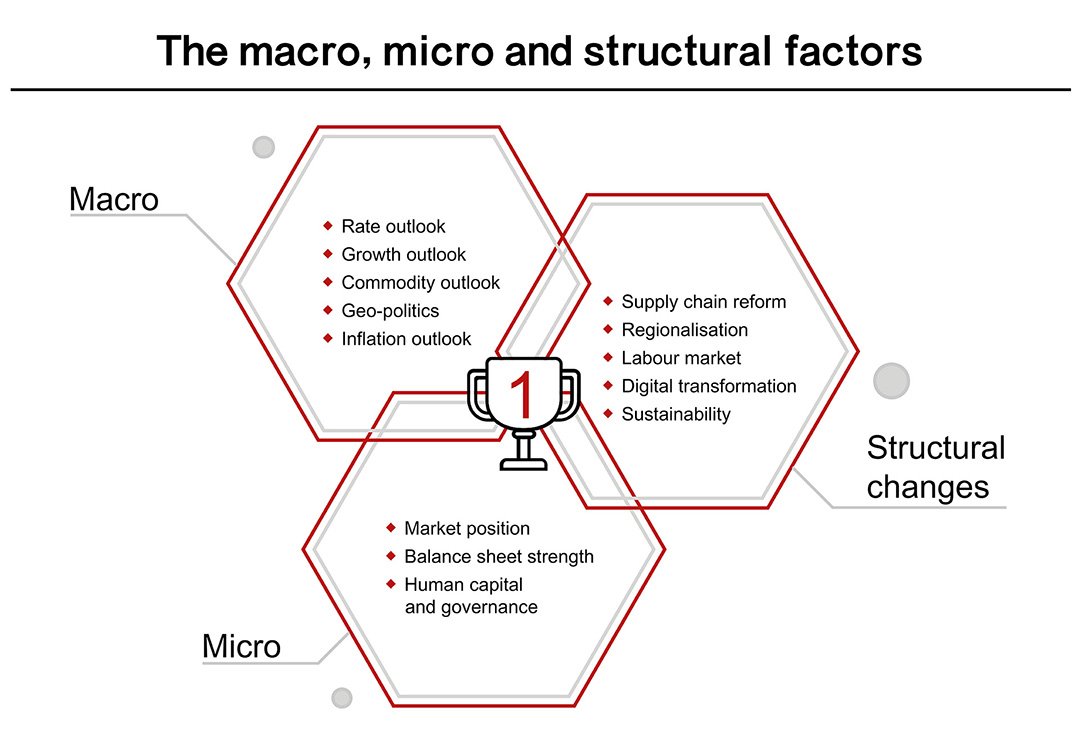

Since late 2021, stagflation concerns have hit both bond and equity markets, resulting in a double whammy in portfolios, while global growth momentum is slowing. However, many quality companies still manage to generate solid profits despite cost challenges. Diverse earnings outlooks make it essential to pick sectors, regions, and companies with resilient outlooks. To achieve this, we must take into consideration macro, micro, and structural factors.

Macro factors

We believe that despite Europe's slowing, the world economy should remain out of recession as long as the US and ASEAN economies are experiencing resilient growth. We're also hopeful that China's stimulus will start boosting activity in H2 2022. Our exposure is balanced between defensive and cyclical, focusing on businesses with strong market positions and regional resilience in the US and Asia.

Micro factors

The COVID-19 crisis, the Russia-Ukraine conflict, and the sustainability revolution are altering supply chains, labour markets, energy sources, and infrastructure, transforming our globalised world into a more regional one. This transition will require lots of investment that will ultimately boost growth and make it less volatile, but it will also result in higher inflation than in the past decade.

Structural changes

We find it helpful to use the ESG framework to complement financial ratios to really understand how future-proof a company is.

By looking for companies that score well on the macro, micro and structural measures, we can build a portfolio that is fit for the future.

Our investment strategy for 2022 is based on four key trends, supported by diverse high conviction themes.

To conclude, we focus on quality, income, and diversification to dampen volatility while capturing the potential upside in the second half of the year. In an uncertain world undergoing unprecedented changes, portfolios need to be resilient to cope with volatility, and yet we should not ignore the diversity of investment opportunities.

Discover our latest in-depth investment views and insights in our new brochure, and ask us about specific investment themes.